Performance Hydration, Reimagined: How Cadence is Changing the Game for Trail Runners

From sleep-focused sachets to subscription loyalty, here's a deep dive into their science-backed approach, business model, and lessons for endurance athletes.

Most supplements overpromise and underdeliver. But what if one actually changed your life?

That’s the question I found myself asking after stumbling across a new electrolyte brand called Cadence.

Here’s the quick story.

Lately, I’ve been more intentional about sleep. Mornings feel sharper when I get high quality sleep. I’m able to get my run in before work, I’m more productive, and I actually get to enjoy watching the sun rise with coffee in hand.

But for years, I’d experience the same frustration pattern: I’d wind down, read a bit, get in bed…and just lie there. Twenty, thirty minutes of racing thoughts before sleep would finally arrive. I’d wake up groggy, like I hadn’t slept enough. And my dreams of being active, productive, or enjoying coffee? Gone.

A few months ago, I was watching ultrarunner (and self-described “pro dirt surfer”) Max Jolliffe’s Rae Lakes Loop video (including below because it’s good!).

At the 0:41 mark, something unexpected caught my attention. Not the sweeping Sierra scenery, but a clean, white can he had “already crushed” sitting in his van.

What was this fashionable, minimalist can doing in this objectively cool trail runner’s objectively cool van?

Turns out, it was a Cadence hydration beverage.

Curious, I checked out their Instagram. Straight up vibes.

I dove into their website to learn more. I ended up ordering a sample of their Sleep Hydration Sachets and slept better than I had in years.

That got me hooked.

And now, I want to share what fascinates me about Cadence’s strategy, market positioning, and business model in the context of the broader market. But first, let’s zoom out and talk hydration itself.

The Importance of Hydration for Trail Runners

As trail runners, we know hydration isn’t optional. It’s foundational.

It drives performance, sharpens focus, supports digestion, and helps keep the whole system running. Yet most adults are perpetually under-hydrated. Studies suggest only 25-30%1 of adults are properly hydrated, while as many as 75% of Americans are chronically dehydrated.

Hydration isn’t just about chugging water. Without electrolytes like sodium, potassium, magnesium, and calcium, water doesn’t get absorbed or used effectively.

For endurance athletes, that balance is even more critical. Hydration fuels effort, speeds recovery, and keeps the body functioning under the strain of long miles.

Size & Growth Potential of the Electrolyte Market

Before diving deeper into Cadence, it’s worth asking why are new hydration brands popping up now?

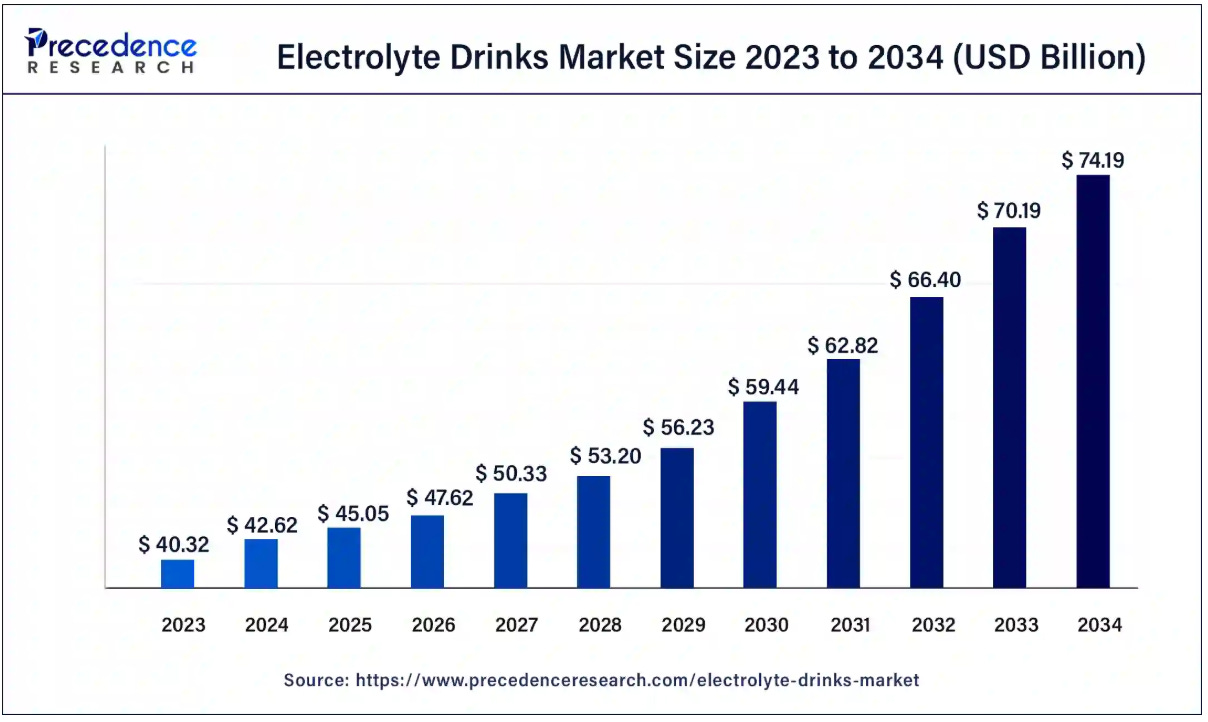

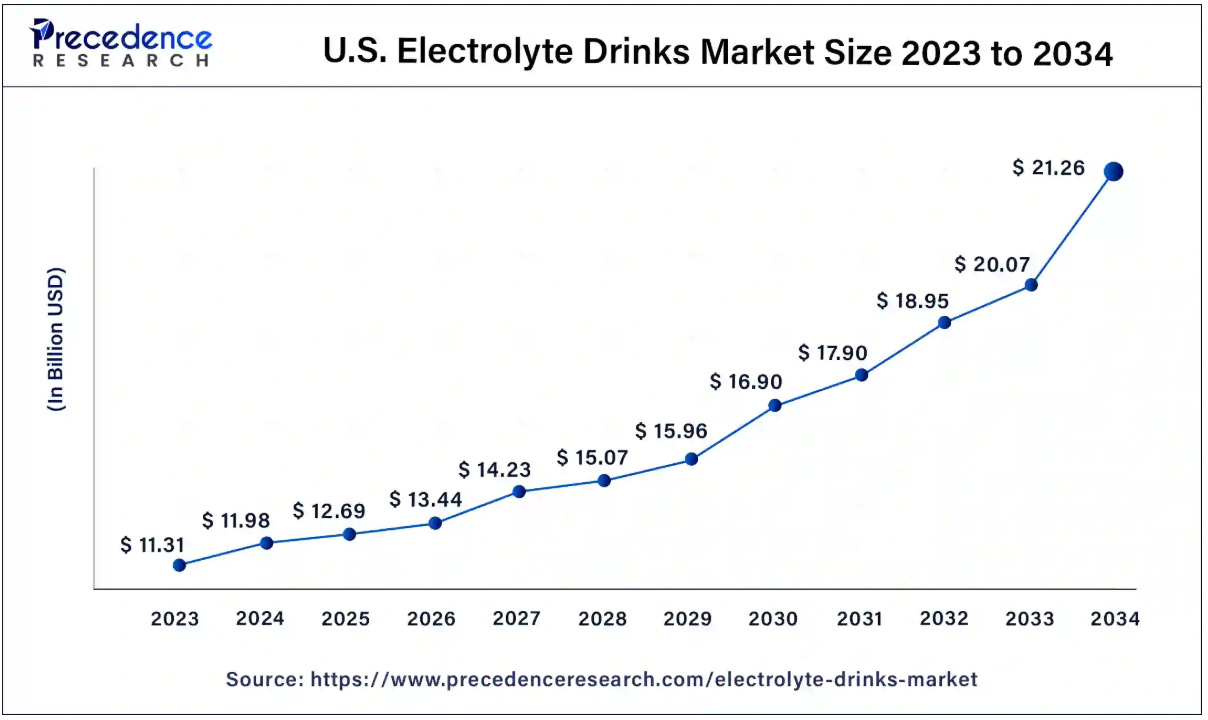

The answer lies in the market. The global electrolyte category is already massive, estimated at ~$42.6 billion in 2024 and projected to top $74 billion by 20342 (a 5.7% compound annual growth rate (CAGR)).

In the United States, it’s an ~$11.3 billion market that’s expected to nearly double to $21.3 billion over the same period.

Hydration supplements are growing even faster, from ~$20 billion in 2024 to a projected $40 billion by 2034 (7.3% CAGR).

To put that in perspective, the global running shoe market is already around $52 billion in 20243 and still growing.

Put simply, performance hydration sits at the intersection of two booming markets: endurance sports and supplements, both of which are expected to expand rapidly over the next decade. As a result, the performance hydration market may be a prime candidate for disruption.

The Performance Hydration Market in Flux

“Performance hydration” is a loaded term. It can mean anything from mass-market drink mix on the shelf at Target to a lab-engineered solution to Himalayan salt and electrolyte tablets.

To make sense of the landscape, I think about two axes: hydration vs. fuel and retail vs. direct-to-consumer.

Hydration vs. Fuel

The simplest rule of thumb? Calories and carbs.

Everyday Hydration

Low or zero-calorie (< 20 cal, < 2g carbs per serving)

Focused on electrolytes for daily absorption and balance

Examples include: Cadence, LMNT, Liquid I.V., Nuun, etc.

Most come in sachets or tablets, designed for recurring use. The challenge here is commodification, which forces brands to differentiate on:

Cost — Price per serving vs. ingredients or quality

Brand identity — Performance, science-backed, lifestyle

Business model — One-off retail purchases vs. subscriptions

Distribution channels — Retail (Amazon/Target) vs. direct channels

In short, everyday hydration covers nearly every consumer persona, from mass-market drinkers to niche performance seekers.

Performance Nutrition

More than 80 calories and 20-60g of carbs per serving = fuel

Combines carbs + electrolytes for in-race fueling

Not necessarily for everyday use

As I wrote in Why Trail Running Nutrition Costs $4 Per Serving, these products are targeted squarely at endurance athletes and carry higher unit economics thanks to ingredient lists, research & development, and marketing.

For the rest of this article, I’ll focus primarily on everyday hydration and how Cadence is carving out space in that landscape.

Retail vs. Direct-to-Consumer

Unlike hydration vs. fuel, which is cut and dry (calories and carbs), distribution sits on a spectrum.

Big brands (Gatorade, Propel) dominate retail

Mid-size brands sell across multiple channels: DTC websites, Amazon, The Feed, Target, grocery stores

Smaller/niche brands often start DTC only, but many expand outward

High Level Brand Playbooks

To see how some hydration and nutrition brands have scaled, here are a few quick playbooks (not all-inclusive):

Gatorade — The mass-market giant. Born in team sports, now positioned as high-performance. PepsiCo-owned. Less relevant in trail running.

Liquid I.V. — DTC start, scaled through retail, acquired by Unilever. Framed as “everyday hydration”.

LMNT — Sugar-free, high-sodium packets. Built via DTC subscriptions, expanded to Amazon/Walmart. Performance-first following. Popularized through Huberman Lab.

Gnarly — Outdoors-first brand with trail credibility. Sells DTC and through specialty shops like The Feed.

Nuun — Tablet format, essential electrolytes. Widely available across retail.

How Cadence Charted a Different Path

From what I can tell, Cadence has diverged from the typical hydration playbook in three ways:

🧪 Credible, Science-Backed Positioning

Cadence devotes an entire section of its site to hydration science, explaining electrolyte absorption and backing claims with peer-reviewed studies. Articles cover topics like:

It’s a brand voice rooted in legitimacy, not fluff.

💧 Everyday Solutions for Endurance Athletes

Rather than a one-size-fits-all drink, Cadence launched with a performance-oriented trifecta:

Core — Daily hydration and electrolyte balance.

Race — Zero-calorie exercise fuel with 100mg Caffeine + 200mg L-Theanine.

Recover — Sleep-focused recovery blend with amino acids, adaptogens, and minerals.

The products map neatly to an athlete’s day: hydrate, perform, recover. No ambiguity.

🚛 Distribution Channels

Cadence sells primarily through its own site, plus select specialty shops that align with its high-performance ethos (stores have to apply to become partners).

Its business is built around the Fuel Club subscription, which rewards actions like purchases, referrals, or follows, while offering 15% discounts on subscription purchases vs. one-off buys. By steering customers away from mass retail and toward subscriptions, Cadence locks in higher-margin recurring revenue while cultivating brand loyalty with its target niche of endurance enthusiast customers.

What Other Brands Can Learn From Cadence

When I see a company carving out an edge, I always ask: what lessons translate to the rest of the market? With Cadence, three stand out:

(1) Clarity of Positioning → Specialize, Don’t Generalize

Cadence drew a sharp line between hydration and fuel, then built clear products for each moment: Core (daily hydration), Race (in-activity performance), and Recover (sleep).

The result? Athletes know exactly what to take and when. Brands that own a lane earn trust. Brands that try to be everything may get ignored.

(2) Channel Strategy → Credibility Over Reach

Rather than chase Target shelves or Costco pallets, Cadence leaned into specialty credibility:

Direct-to-athletes online

Select running shops

Athlete advocates

The trade-off is less visibility, but the payoff is stronger margins and a tighter brand identity.

(3) Retention Mechanics → Subscriptions That Stick

Cadence’s Fuel Club and subscription offerings turn one-off buyers into recurring customers. By creating loyal customers, Cadence generates predictable, margin-friendly recurring revenue.

What Trail Runners Can Learn from Cadence

If you’ve made it this far, you might be thinking: Cool story, but how does this help me?

As athletes and customers, a few lessons jump out:

(1) Hydration ≠ Fuel

Hydration = electrolytes to replace sweat and keep performance steady.

Fuel = carbs and calories for energy on the run.

Use both with intent.

(2) Trail Like You Race

Hydration isn’t just for race day. Practice your strategy in daily life and long runs. You’ll adapt faster, recover better, and (hopefully) avoid late-race issues.

(3) Niche Beats Mass-Market

Cadence designs for performance, not the masses. That specificity makes their products especially relevant for trail and ultra athletes who go long and hard. Sometimes the best products are the ones built for you, not everyone.

(4) Subscriptions Support Consistency

Think of it less like a lock-in and more like a system. Automatic resupply, no gaps in training. The less you have to think about logistics, the more you can focus on running.

(5) Trust & Credibility Builds Confidence

Cadence leans into science to build credibility and trust. For runners, that means less guesswork and more confidence in your hydration plan.

What Do You Think?

Will Cadence eventually scale or stay niche?

Is its branding and science-backed strategy enough to defend against commodification?

What happens if and when larger companies start to come play in this space, either directly or through acquisitions?

I’d love to know what you think!

The Aid Station

Miscellaneous quick hits. Trail style. Actionable, digestible, essential.

🎥 Must-Watch: Jenn Lichter on The Freetrail Podcast

I didn’t expect to feature Freetrail two weeks in a row, but Jenn’s episode is unmissable. Vulnerable, powerful, and inspiring. It’s the kind of conversation that reminds us why we love this sport.

🏃 Front-of-the-Pack Storytelling: ’s Western States Race Report

From climbing into Robinson Flat to a 40-mile chess match with Kilian Jornet, Jeff’s recap pulls you inside his phenomenal Western States debut instead of just showing you results. These kinds of firsthand accounts are so fun to read. I hope we see more athletes share reflections like this.

📊 WSER Foundation Financials Update

Way back in my first newsletter, I wrote about the Western States Endurance Run Foundation’s non-profit setup and 2023 financial performance.

The organization just released its 2024 Form 990. A few standout numbers:

$1.06M in revenues (vs. $1.2M in 2023)

$1.06M in expenses (vs. $1.16M in 2023), including $108K for the live broadcast

The WSER Foundation has $423K in stock investments

The organization has $450K in deferred revenue. This is interesting because it represents a cash payment that has not yet been earned (e.g. sponsorships already paid but tied to future events?)

What it matters: Western States is one of the only major trail races structured as a nonprofit. Its transparency gives us rare visibility into how money flows at the top of the sport and how much it really costs to put on a world-class event.

Study was performed on adults in the U.S. but can be used as a proxy for adults in most developed countries.

Precedence Research. Electrolyte Drinks Market Size | Share and Trends 2024 to 2034.

Interesting analysis! I find Cadence to be a bit heavy on style, light on substance. Many brands offer solutions for salt, why did Cadence launch a canned water drink with added salt and position it as a performance product? Not that athletes don't need salt, but I trust brand like Skratch of Precision much more because they offer cover other macros as well as electrolytes. The brands specializing in salt and such feel like cash grabs to me.

Always a good read, thanks!